Core-Services

Strategy & Organisational Change

Operational Excellence

Outsourcing Management

Reporting & Business Intelligence

Experts as a Service

Regulatory & Compliance

01

lStrategy & Organisational Change

We assist in defining an optimised organisational structure and process organisation. By using comparative values and best practices, we jointly identify potentials for process and cost optimisation as well as roles and responsibilities in the organisation. In this context, we examine the potentials and different possibilities in a structured way.

We analyse the different processes, standardise them and define the necessary interfaces.

Together with you, we streamline the structures along the processes and define KPIs and control parameters for sustainable success. In doing so, we pay attention to automation and digitalisation potentials and design them for implementation.

The establishment of transparent business processes enables you to independently initiate continuous improvements.

Recent Projects:

- Setup of new European and third party branches in Germany: coordination with internal stakeholders, legal and tax advisors and external regulators on transition phase, employment relationship, intra-group outsourcing and legacy topics like employees pensions

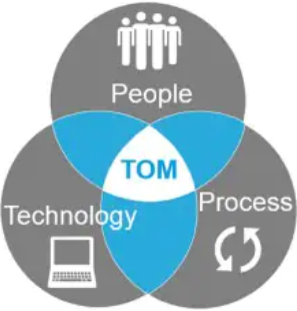

- Assessment and implementation of a Target Operating Model (TOM) for the global Regulatory Affairs department of an international bank including support to BAU phase

- US Person Transparency TOM: Consolidation of regulatory requirements with regard to US Persons and pricing/billing/booking related questions across Legal, Finance, Operations and IT and impact on TOM. Definition and mitigation actions with regard to earmarking engine, eligibility engine, operational dependencies and front-to-back control framework.

02

Operational Excellence

Our experts ensure your success.

Our experts listen, analyse and reduce complexity to get things done. This is how we create value through transformation, even in challenging phases. Whether as a coach or as a manager, in PMO support or as a project manager, as a business consultant or as a business engineer, whether testing or quality assurance, as migration or cutover manager, whether partial or overall mandates with corresponding responsibility.

We work shoulder to shoulder with you. We look where others look away – we stand up for the success of our customers.

Recent Projects:

- FATCA Control & Compliance Framework: Execution of Global FATCA Controls & Compliance Considerations, Direct report to Group Responsible Officer / Global Head of Compliance, strategic considerations with regard to Regulatory Affairs and projects (e.g. OECD AEI / CRS)

- Austrian Withholdings Tax (KEST 2011/2013 Changes): Implementation of KEST 2013 taxation law (update to 2011) on financial instruments, remediation and cleansing of historical transaction data with regard to KEST, currencies, holding period, etc., data migration and testing of new taxation engine

03

Outsourcing Management

Due to competitive market situations, financial organisations are faced with the challenge of cutting costs while at the same time complying with regulatory standards. In this context, outsourcing is gaining importance.

Although outsourcing offers significant optimisation potential, the monitoring and management of service providers and contracts in most institutions leads to highly manual and complex processes.

We assist you in making economically appropriate make-or-buy decisions and at the same time comply with the regulatory requirements of MaRisk.

Recent Projects:

- Strategic assessment and planning of outsourcing business & operations functions and procedures (incl. CID) outside CH to leverage existing centrally maintained capabilities of an online trading bank

04

Reporting & Business Intelligence

Organisation. Scalability. Big Data & Performance.

We help you to have a clear understanding of the regulatory requirements as well as the requirements of stakeholders in your organisation. We work with you to develop the technical process requirements, the data field definitions and reporting structures, formulate the technical concept for the IT, support you in a possible software conversion and check the plausibility of the system implementation as part of a test and defect management.

Recent Projects:

- European/Italian/French Financial Transaction Tax: Traceability and implementation of regulatory requirements into Global Business, Operations and IT, monitoring of risks, issues and deliverables (cross stream and international), preparation of senior management and stakeholder communication

05

Experts as a Service

Whether a specialist or an interim manager is needed at short notice. In our consulting team you will find personalities with special professional skills for a successful cooperation in the area of Finance & Banking.

For example Business Analyst, Technical Consultant, Program/Project Manager, PMO, Process Manager or Test Manager.

Recent Projects:

- Subject Matter Expert for OECD Automatic Exchange of Information

06

Regulatory & Compliance

Financial institutions operate in a complex environment characterised by constantly changing rules and regulations. In the area of Regulatory and Compliance, we support you with sector-specific know-how and many years of experience.

Our expertise lies in understanding regulatory requirements and illustrating the resulting subjects for your business in the simplest, clearest and most pragmatic way possible. We help with the strategic analysis, define change steps and accompany the transformation to ensure a successful implementation.

Recent Projects:

- Implementation of International Tax Compliance AEI: Global impact assessment and development of a cross-stream and international target state, implementation plan and budgeting

- Financial Transaction Tax: Traceability and implementation of regulatory requirements into Global Business, Operations and IT

- Execution of Global FATCA Controls & Compliance Considerations

Selected Success Stories

Topic: F2B Digitalisation

Challenge:

- Highly fragmented processes and systems

- Siginificant manual interactions

- Missing MI overall

Approach:

- Definition of overall program standards and templates

- Regular reporting to program management, business unit leads, sponsors and STC

- Standardised process assessment, design, business requirements, handover to IT implementation and post go-live support

Achievements:

- F2B digitalisation of processes

- Central monitoring application

- Basis to define strategy for 2020

Topic: TOM definition/transition

Challenge:

- Definition of a TOM for a global function

- Maintaining BAU

Approach:

- Structured assessment of the global Regulatory Affairs Organisation

- Assessment of requirements from key stakeholder within and outside the organization

- Development and design of TOM options and risk mitigation measures

Achievements:

- Global TOM

- BAU support: Board of Director and Executive Board meetings and management communication (key focus topics and developments)

Topic: Brexit migration

Challenge:

- Political instability and short-term decisions

- Continuity of EMEA wide client business

Approach:

- Advice Management Board on Loan Migration approach (cross-stream alignment)

- Assess current governance structure and (re-)develop target state considering additional businesses to be migrated, e.g. Secondary Loan Trading and Loan Underwriting

- Support on legal, regulatory, risk and tax related matters regarding business approval and migration

Achievements:

- Migration of corporate loan book

- Operational readiness